Zero Storage, Maximum Speed: How Walmart Bet the House on Cross-Docking

23-Jan-2026 - SCM4ALL Team

If you walk into any of the 4,600+ Walmart stores in the United States today, you will likely find the shelves stocked with everything from fresh bananas to 85-inch televisions. It seems effortless, but beneath those aisles lies one of the most efficiently engineered logistics machines in history. At the very heart of Walmart’s "Everyday Low Prices" (EDLP) is a strategy called Cross-Docking.

What is Cross-Docking?

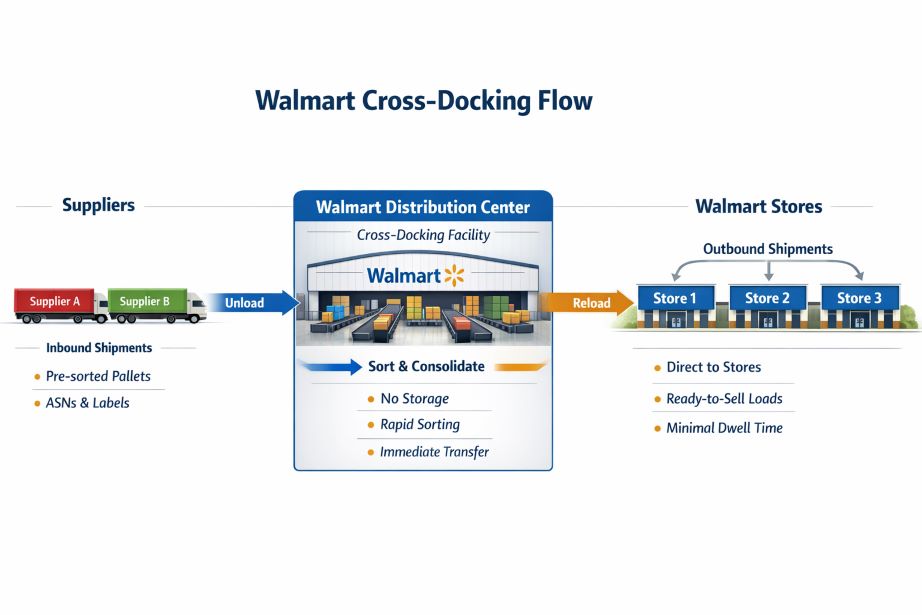

In traditional warehousing, goods are stored on high racks for weeks or months. Cross-docking is a logistics practice where products are distributed directly to a store with marginal to no storage time. Think of it like a connecting flight: you don't check into a hotel (storage); you sprint across the terminal to board your next flight (shipping). At a Walmart Distribution Center (DC), products typically spend less than 24 hours inside, and often just a few hours.

Why Use It? The Three Pillars

- Cost Reduction: By eliminating "put-away" and "picking" steps, Walmart shaves massive labor and storage costs.

- Inventory Velocity: It shifts from "supply-push" to "demand-pull," freeing up billions in working capital.

- Speed and Freshness: A day saved in the warehouse is an extra day of shelf-life for produce.

The Mechanics & Tech Enablers

Walmart DCs are often designed in an "I-shape" to minimize the distance between receiving and shipping docks. This is powered by:

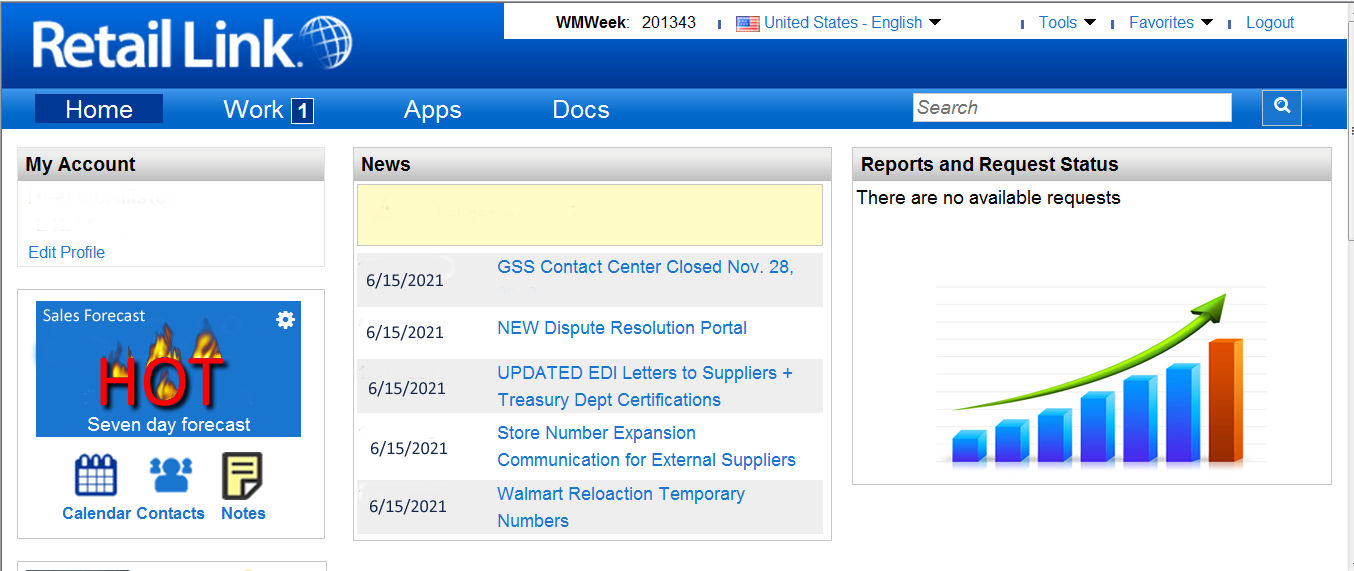

- Retail Link: A proprietary software connecting Walmart to suppliers, providing a "single version of the truth" for sales data.

- RFID & Advanced Barcoding: This allows Walmart to track inventory through dock doors without human scanning, speeding up flow dramatically.

- Predictive AI: AI predicts demand based on weather and local events to adjust flow proactively.

Rules of Engagement: Sourcing & Metrics

Walmart uses its scale to enforce strict behavioral agreements:

- Vendor-Managed Inventory (VMI): Suppliers are responsible for monitoring inventory and triggering shipments.

- The "OTIF" Mandate (On-Time In-Full): Shipments must arrive within a strict window—neither late nor early. Missing these targets results in penalties, often 3% of the Cost of Goods Sold.

The Financial Goal: High GMROII

$$GMROII = \frac{\text{Gross Margin}}{\text{Average Inventory at Cost}}$$Cross-docking boosts this by keeping average inventory extremely low.

Comparison: Small Retailers vs. Walmart

| Feature | Smaller Retailer Model | Walmart Cross-Docking |

|---|---|---|

| Storage Time | Weeks or months | Hours (< 24 hours) |

| DC Goal | Buffering uncertainty | Throughput and speed |

| Risk | Obsolete inventory | Operational sync failure |

Why Walmart’s Cross-Docking Is a Tightrope Walk

For all its efficiency, Walmart’s dependence on cross-docking is a high-stakes gamble. By removing the "buffer" of traditional warehouses, Walmart has traded safety for speed. Here is why this system is considered a "tightrope walk":

Summary: While cross-docking saves billions, it leaves Walmart vulnerable to "Black Swan" events. One major port strike or a regional power outage can disrupt the flow-through logic that the entire Everyday Low Price model relies upon.

The Clash of Titans: Walmart vs. Amazon IXD

While Walmart cross-docks for Replenishment (getting goods to store shelves), Amazon cross-docks for Placement. Amazon uses specialized Inbound Cross-Dock (IXD) facilities as "air traffic control" to redistribute vendor shipments across its national network.

Inside Amazon's IXD Architecture

Amazon's network uses two layers:

- National IXD (nIXD): Massive facilities that break down bulk pallets for different regions.

- Regional IXD (rIXD): A middle layer that fine-tunes distribution to local Fulfillment Centers (FCs).

Did you know? Through Shadow Inventory, products become "Available for Sale" on Amazon the moment they are checked into an IXD, even while still on a truck to their final FC.

The Financial Strategy: Placement Fees

In 2024 and 2025, Amazon shifted its fee structure:

- Inventory Placement Service (IPS): Sellers pay a fee if they ship to only one IXD, as Amazon must do the splitting.

- Optimized Splits: Sellers can avoid fees by shipping to 5+ locations themselves, often saving 5–10 days in transit.

IXD vs. AWD (Amazon Warehousing & Distribution)

Don't confuse the two! AWD is for long-term bulk storage (like a spare room), while IXD is a sorting machine (like a post office).

Conclusion

Walmart's cross-docking mastery proved that data could replace inventory. Whether it is Walmart's hub-and-spoke replenishment or Amazon's predictive IXD placement, the goal remains the same: velocity. For any supply chain student, these facilities remain the gold standard of modern distribution.